Expense reporting requires organisation, patience and attention to detail. These skills are especially needed when you’re dealing with manual expense reporting. But with automated expense reporting, it becomes much easier, quicker and more efficient.

Manual vs Automated Expense Reporting: What’s the Difference?

The difference between manual and automated reporting may be self-explanatory, but let’s zoom in on these specific factors:

1. Adaptability

In the new normal of flexible business environments, it's becoming an important skill—and need—to complete tasks on the go. When you do manual expense reporting, this is quite impossible. Someone from the finance department will need to be in the office for a claim to be made. You’ll also need a manager to be there to sign off on it.

Automated expense reporting allows for adaptable expense management because you can work on claims no matter where you are as long as you have an internet connection.

2. Mobile-Friendliness

Mobile-friendliness works very closely with adaptability, but they’re not the same. For example, an expense spreadsheet may be accessed from your phone, but is it mobile-friendly? Chances are, you’ll have a hard time looking at the data because of the seemingly endless cells.

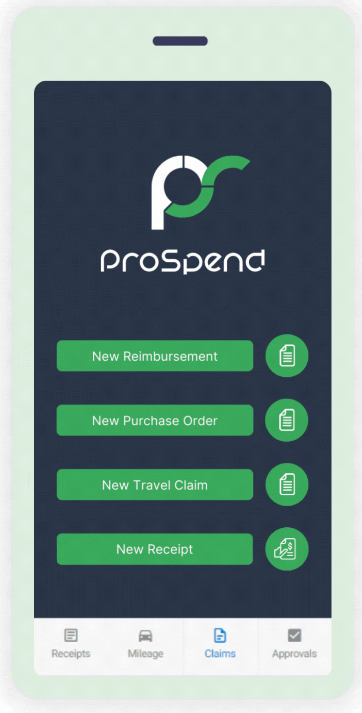

When you use an automated expense management system, you get to access your expense platform not just on the go, but also in a format that works great on your mobile device.

3. Speed

An automated expense management system allows you to instantly create reports without the need to manually generate data from an expense spreadsheet. Imagine how much time you can save (and how many more tasks you can accomplish) by generating reports automatically! You can also be certain that the speed does not compromise the quality and accuracy of the reports.

Plus, with instant reports, a business can proactively make decisions based on the data.

4. Efficiency

Expense management tasks such as receipt reporting are not just tedious when done manually; they’re also prone to dealing with misplaced receipts and documents. Manual expense reporting, therefore, runs the risk of employees and employers not being able to properly track, report and manage expense claims.

Automated expense reporting, on the other hand, lets you instantly capture receipts with just a picture of the document. It then stores the photo with other important details in your account, making the whole process easier and more efficient.

You can also improve your efficiency when it comes to reporting. While a manual system simply records whatever you input, an automated system collates the data and organises it. This makes it easier for businesses to efficiently manage business spend.

5. Flexibility

Automated expense reporting makes it easier to quickly input all your important data. You can also easily reconfigure reports to analyse the data in different ways.

Also, an automated expense management system has a wide range of languages and currencies, making it easier for you to automatically calculate conversions.

What Are the Challenges in Manual Expense Reporting?

We sometimes tend to stick to traditional systems despite their limitations and challenges because that’s what we’re used to. However, once you realise that manual expense reporting has more risks than benefits, you might just decide to make the switch.

1. Lack of security

A manual expense reporting system doesn’t have any fraud detection capabilities. While you can opt to use an expense spreadsheet’s password-based security and cell-locking features, it can’t protect your data the way an automated expense management system can.

2. Difficulty to analyse data

When you use spreadsheets—or worse, physical pieces of paper—for expense reporting, it becomes difficult and impractical to analyse information. People who deal with such data need to have enhanced visibility of it, and with manual reporting, that can be pretty impossible to attain.

3. Inability to find or avoid errors

Manual expense reporting often leads to inevitable human errors. We tend to see double, miss an important detail or accidentally press the same key twice. When you do manual expense reporting, you likely won’t notice that an error has been made. Automated expense reporting, on the other hand, can immediately flag when something seems out of place.

4. Cost

One of the most common misconceptions about manual expense reporting is that it costs less, but it’s actually the opposite. You don’t just spend money on physical resources (e.g., paper, stationery, storage space); you also spend too many physical resources themselves. Plus, data on paper is a lot harder to backtrack when you need to do so in the future.

5. Time consumption

The whole process of manual expense management is time-consuming. When an employee files a business expense, it goes through a long series of processes before it finally gets approved.

An automated expense management system can send reminders and prompt the approver. Plus, the whole process is done digitally.

How Is Automation Better?

If we were to summarise automation in three ways, it would be easier, quicker and more efficient.

1. Easier

Employees can just upload images of their receipts, and the software will immediately extract details. This leads to easier reporting. The automated expense management software can also notify the user of any issues or violations and spot any fraudulent activity.

2. Quicker

Who doesn’t love fast, quick and effective processes? Automated expense software has a better workflow that reduces delays. Get rid of manual reviews and analysis and let the software do the work.

3. More efficient

Let’s admit it: using manual processes and paperwork is pretty much a step backwards. Automation eliminates tedious analysis and error-prone reports. Since expense management software lets processes happen digitally, the whole procedure becomes seamless.

While manual expense management may be something you’ve been doing for years, it can hinder you from efficient and productive spend management. Automated expense reporting comes with so many more advantages, and it makes expense management so much simpler.

Why stick to traditional ways when automated platforms make the job easier? Book a demo with us and see what we mean.