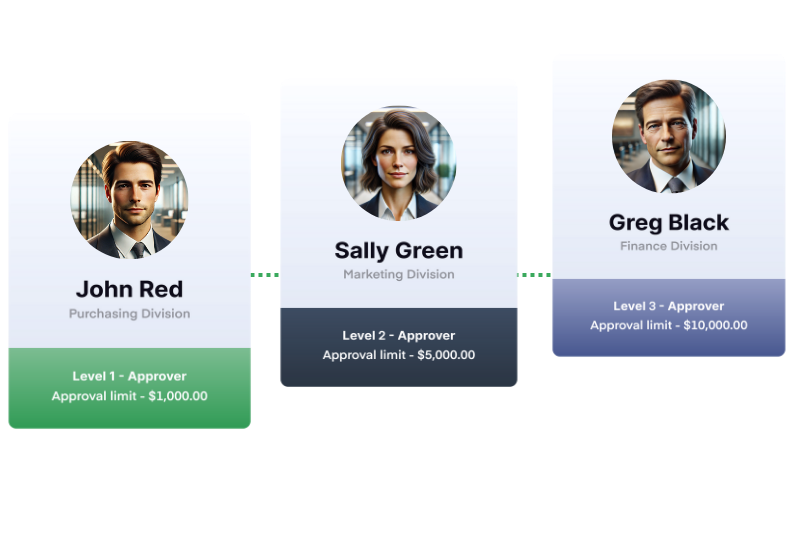

Customisable approvals for every spend type

ProSpend’s flexible approval workflows adapt to your business needs, allowing you to easily configure tailored workflows for expenses, invoices, purchase orders, and travel.

Over 1,000 customers trust us since 2015

Integrations with 30+ leading ANZ ERPs

Dedicated implementation and local support

MYOB Innovative App of the year finalist

Tailored approvals for every business & every spend type

Every business is unique, and so are its approval needs. Different spend types—expenses, invoices, purchase orders, and travel—often require distinct workflows.

That’s why ProSpend is built to support customized approvals across all areas of spend, giving you the flexibility to automate and streamline approvals in one unified platform

.png?width=600&height=180&name=friends%20(2).png)

Purchase with confidence - proactively manage spend

Control spend before it happens with ProSpend's easy-to-implement purchase order module. Using purchase orders ensures spending is planned, approved, and tracked upfront, preventing budget blowouts and unexpected costs.

With automated approval workflows, purchase orders streamline the buying process so when the invoice is received there are no delays in sign off for payment.

Be proactive, not reactive, with smarter spend management

.png?width=1200&height=825&name=po%20header%20(1).png)

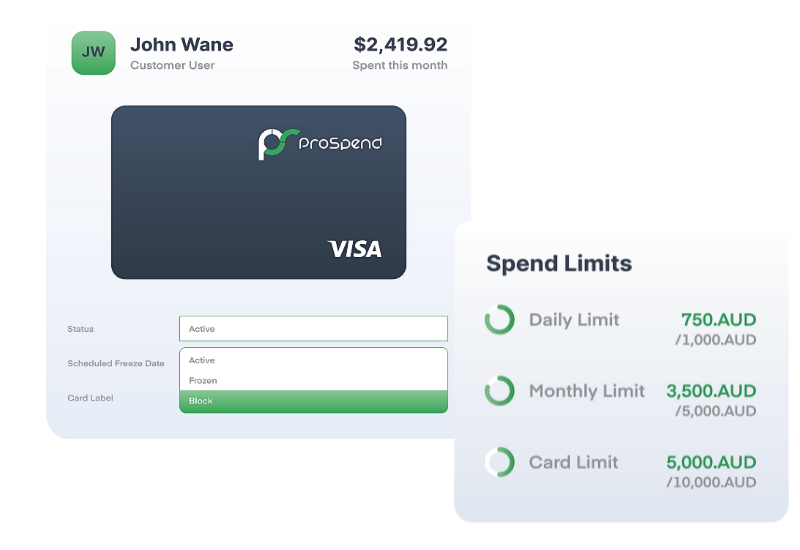

Pre-approved spend, built directly into your cards

With ProSpend virtual cards, you set spending limits and restrictions upfront, ensuring every transaction is pre-approved before it happens. Employees know exactly what they can spend, eliminating the need for the "ask for forgiveness" policy and reducing out-of-policy expenses.

By embedding control into every transaction, finance teams gain full visibility, compliance is ensured, and employees can focus on their work without unnecessary delays or approvals.

Keep your teams moving while maintaining total control over business spend

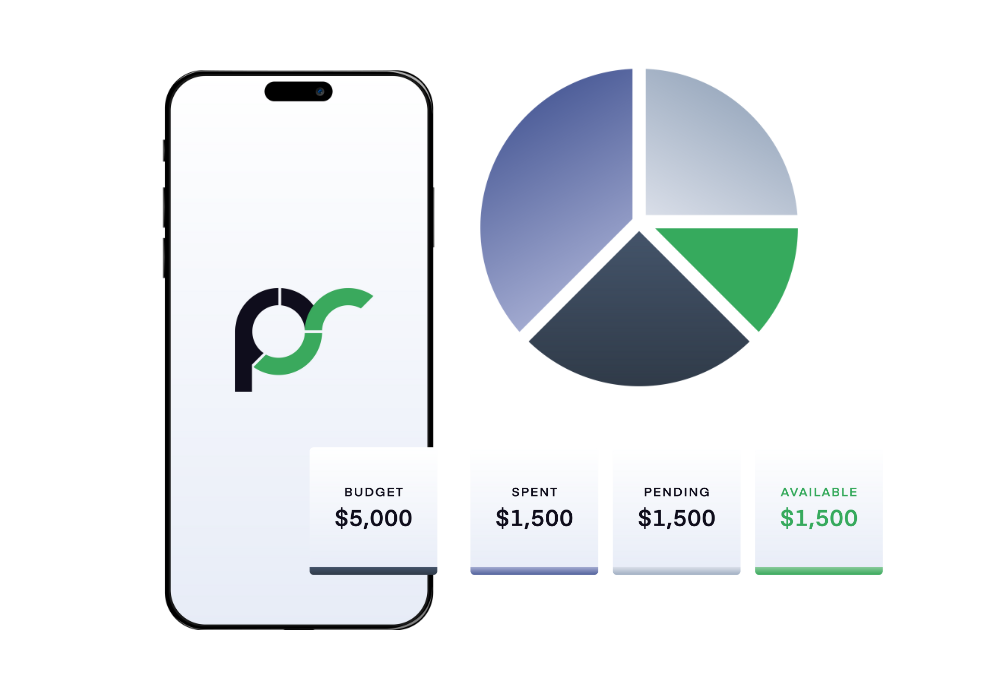

Approve with Confidence – Stay on Budget, Every Time

With ProSpend’s Visible Budget Module, approvers gain instant clarity on every approval decision. Whether it's expenses, invoices, purchase orders, or travel, approvers can see in real-time whether the spend request is within budget or exceeding limits before approving.

This proactive insight ensures better financial control, prevents budget overruns, and enables smarter decision-making—keeping business spend aligned with company goals without slowing down approvals.

.png?width=1200&height=825&name=budget%20approvals%20(3).png)

The Critical Final Check: Ensuring Accuracy Before Payment

Finance teams need full visibility and control before payments are processed. ProSpend’s 'last mile' check allows teams to review, edit, or send back expense claims and invoices to correct errors, miscodings, or discrepancies.

With two flexible approval workflows, businesses can ensure payments are accurate, compliant, and aligned with budgets—before funds leave the business.

.png?width=1200&height=825&name=payer%20rights%20(1).png)

What our customers say

Join these modern finance teams that trust ProSpend to automate their business spend.

Visible budgets for proactive spend

Whether it's expenses, invoices or pre-spend with purchase orders our Budget Module gives employees visibility at the time of spend so they can make sensible and smart decisions:

✅ Easy to set up and manage

✅ Track spend against budgets in real time

✅ No more hidden spreadsheets

One platform for all your business spend

Easily manage your expenses, invoices, purchase orders and cards all in one unified platform

FAQ

Category 1: Understanding Approvals Workflows

What is an approvals workflow and why do finance teams need one?

An approvals workflow is a structured process that routes spend requests—like POs, invoices, expenses and card transactions—to the right approvers before money is committed. ANZ organisations rely on approvals to control budgets, prevent unauthorised spend and ensure policy compliance. It removes the guesswork and manual chasing that happens with email-based approvals.

Why do manual email approvals cause issues?

Email approvals are difficult to track, slow to follow up, and prone to being overlooked, especially across multi-site or multi-entity teams. They also lack proper audit trails, which can create issues during audits or funding reviews. A dedicated workflow system keeps everything standardised and visible.

What type of spend should go through an approval workflow?

Typically POs, invoices, reimbursements, travel requests and card transactions. Anything that impacts budgets or requires policy oversight should pass through a structured approval chain.

Category 2: How ProSpend Approvals Work

How does ProSpend route approvals?

ProSpend uses rules based on dollar thresholds, cost centres, departments, entities or project codes. Requests automatically go to the correct approver, with notifications sent by web or mobile. This ensures approvals progress quickly without finance needing to chase people manually.

Can ProSpend handle multi-level or conditional approvals?

Yes. You can configure multi-step workflows where requests escalate based on value, category, policy or risk. This is particularly useful for councils, NFPs and university faculties that require strict oversight.

Are approvers required to log in to approve requests?

Approvers can approve from desktop or mobile and receive instant alerts. The experience is designed to be simple so approvals don’t create delays in fast-moving environments.

Does ProSpend support budget checks before approval?

Yes. Approvers see real-time budget impact before approving. This allows managers to understand whether the request fits within remaining allocation and prevents overspend.

Category 3: Controls, Compliance & Audit

How do approval workflows support compliance?

ProSpend enforces approval pathways that align with internal policies, procurement rules and funding guidelines. Every approval is logged, timestamped and linked to supporting documents. This creates a clear audit trail aligned with ANZ expectations for councils, NFPs and government-funded organisations.

Can approval workflows help with GST or FBT accuracy?

Yes. Because transactions are coded and categorised during submission, ProSpend applies consistent GST and FBT logic across POs, expenses and invoices. Approvals ensure coding is validated before reaching the ledger.

Does ProSpend keep approvals separate across multiple entities?

Absolutely. Each entity can have its own rules, approvers and coding structure. Shared-services teams gain visibility without mixing approvals across ABNs.

Category 4: Integrations, Setup & Fit

Which systems does ProSpend integrate with for approvals?

ProSpend integrates with Xero, MYOB, NetSuite, Business Central and Acumatica. Approved transactions export cleanly with accurate coding, tax treatment and entity information.

How long does it take to configure approval workflows?

Most teams configure and go live in 4–10 weeks, depending on complexity and number of entities. ProSpend’s Australian-based specialists guide setup, testing and training.

Do we need to redesign our current approval hierarchy?

Not necessarily — ProSpend can mirror your existing processes. Many organisations refine their workflows during implementation to remove bottlenecks and improve governance.

Category 5: Competitive Fit & Common Questions

How does ProSpend compare to Concur, Weel or Lightyear for approvals?

ProSpend offers deeper multi-entity approval logic, tighter ERP integration and stronger links between budgets, POs, invoices, cards and expenses. Many ANZ organisations choose ProSpend when they need unified spend governance rather than isolated approval tools.

Can staff approve while travelling or offsite?

Yes. Mobile approvals allow staff to review and approve anytime, preventing delays when managers are on the road, across campuses or working remotely.

What happens if an approver is away?

Backup approvers or delegated authority rules can be set so approvals continue smoothly. This prevents bottlenecks and keeps spend moving within target payment windows.

.png)

.png)