Virtual Cards – The Smarter Alternative

Start controlling business spend the proactive way. Issue cards instantly, control the spend and track transactions in real-time.

Smart, secure cards with built-in spend control

✅ Instant issue ✅ Configure and control spend ✅ Real-time transactions ✅ Automatic claim creation

Ready to see how it works

Check out the video now!

Instantly issue your own cards

Built right into a tried-and-tested comprehensive business spend management system, you’ll have the power to issue, block, edit, track and reconcile cards instantly within the ProSpend platform - ideal for replacing reimbursement and traditional card programs and no more waiting for cards to be sent.

And no more waiting for statements, you can see transactions and monitor card limits in real time by team, individual, and entities, all in a single console to increase accountability.

.png?width=800&height=550&name=issue%20virtual%20card%20(1).png)

Use to pay easily

Once issued, the cards can be easily added to Apple Pay and/or Google Wallets for making contactless payments. They can also be used for online payments and over-the-phone transactions.

With the spending control limits that can be customised and configured down to individual users.

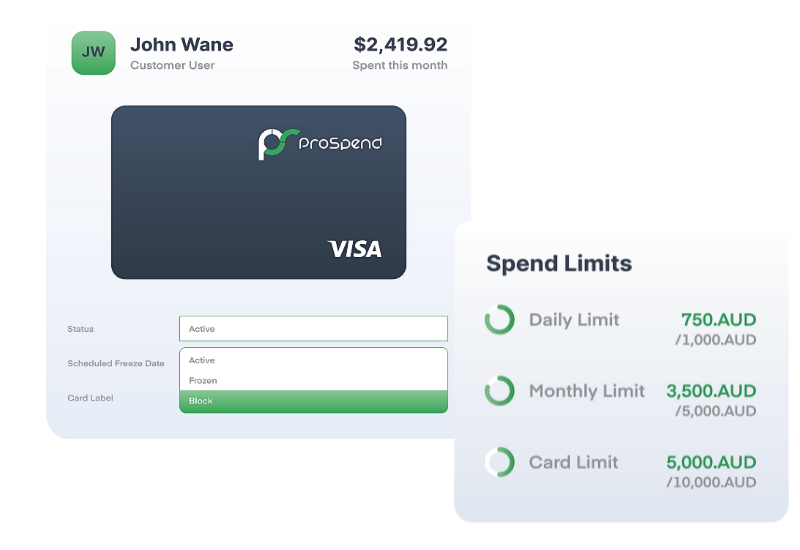

Configure and control spend

Each card can be uniquely tailored to its user when it's active, with a range of options and rules, including:

✅ Per transaction spend limits

✅ Weekly, monthly or lifetime limits

✅ Active limits

✅ Currency

.png?width=1200&height=825&name=fraud%20virtual%20card%20(2).png)

Safe, secure and transparent

✅ Administrators can block, freeze and cancel cards instantly.

✅ Spend safely online without the risk of card fraud or theft. Your spending is protected by Visa, Apple Pay and Google Pay fraud systems

✅ The days of card sharing and fraud risk are over. Issue cards for subscriptions or one-off expenses.

Manage your subscriptions easily

.png?width=1200&height=825&name=subscription%20management%20(1).png)

Fuzzy Events

Hear how ProSpend helped Fuzzy Events manage their unique challenges with the events industry and how ProSpend virtual cards were a game changer.

.png?width=1200&height=800&name=fuzzy%20events%20(5).png)

.png?width=1200&height=825&name=physical%20cards%20(1).png)

When you need to tap

Our physical cards ensure your employees are never left stranded when transacting in remote areas where digital payment infrastructure is still developing.

Explore all the features of Virtual Cards

Virtual Cards include free subscription to our leading expense management platform.

Card and Reimbursements

Edit, submit and approve all claim typesp

Receipt Capture

Snap a receipt with OCR scanning for data entry

Mileage Claims

Mileage claim creation with google maps

Approvals On the Go

Approve or reject claims anywhere, anytime

One platform for all your business spend

Easily manage your expenses, invoices, purchase orders and cards all in one unified platform

Need clarification?

Does this work for reimbursement and card claims?

Where is our data hosted?

What is the best use for virtual cards?

Can approvers and managers work remotely?

Our software is cloud-based, meaning you can work anywhere, anytime.

Can users only create an expense for their cost centre?

Our software allows you to give permissions to your users to allow them to submit claims for expense types available to a set of cost centres.

Can you submit claims on mobile?

Can we have our spend policy enforced?

Yes, users can be prompted of your spend policy when they are creating a claim.

Can I order physical cards?

Yes! Physical cards are now available alongside our virtual cards solution. To know more, reach out to our sales team.

Quick and reliable payments when you need to tap

Give your employees ProSpend physical cards with built-in spend control and security features