Hyperautomated Accounts Payable

Reduce manual processes and get compliance monitoring with ProSpend’s Accounts Payable Automation solutions featuring workflows, invoice approval limits, fraud control and supplier management

Stop fraud in its tracks

Protect your business from invoice fraud with our intelligent fraud control and invoice screening that spots discrepancies and ensures compliance.

.png)

Over 1,000 customers trust us since 2015

Integrations with 30+ leading ANZ ERPs

Dedicated implementation and local support

MYOB Innovative App of the year finalist

Always-on, proactive fraud control

ProSpend works around the clock to keep your business safe.

ProSpend’s invoice scanning and extraction service is powered by artificial intelligence (AI) and machine learning (ML) which keeps constantly learning with every document it processes.

With continuous monitoring, our platform scans every invoice for potential risks, ensuring that issues like mismatched bank accounts or suspicious activity are caught early.

Stay one step ahead with a solution that prioritises your financial integrity.

-Feb-18-2025-05-00-49-6819-AM.png?width=800&height=550&name=Untitled%20design%20(1)-Feb-18-2025-05-00-49-6819-AM.png)

Trust begins with verification

Fraud often starts with fake or unknown suppliers. ProSpend offers robust supplier verification tools, enabling your business to confirm identities and avoid fraudulent invoices.

As soon as an invoice is received, ProSpend automatically extracts the supplier's details and cross-checks them against our global network of thousands of already verified suppliers, as well as linking directly with the ABR.

If the supplier isn’t verified, an unknown supplier workflow is triggered to ensure your payments remain secure.

It’s fraud prevention made simple, because trust should never be a guessing game.

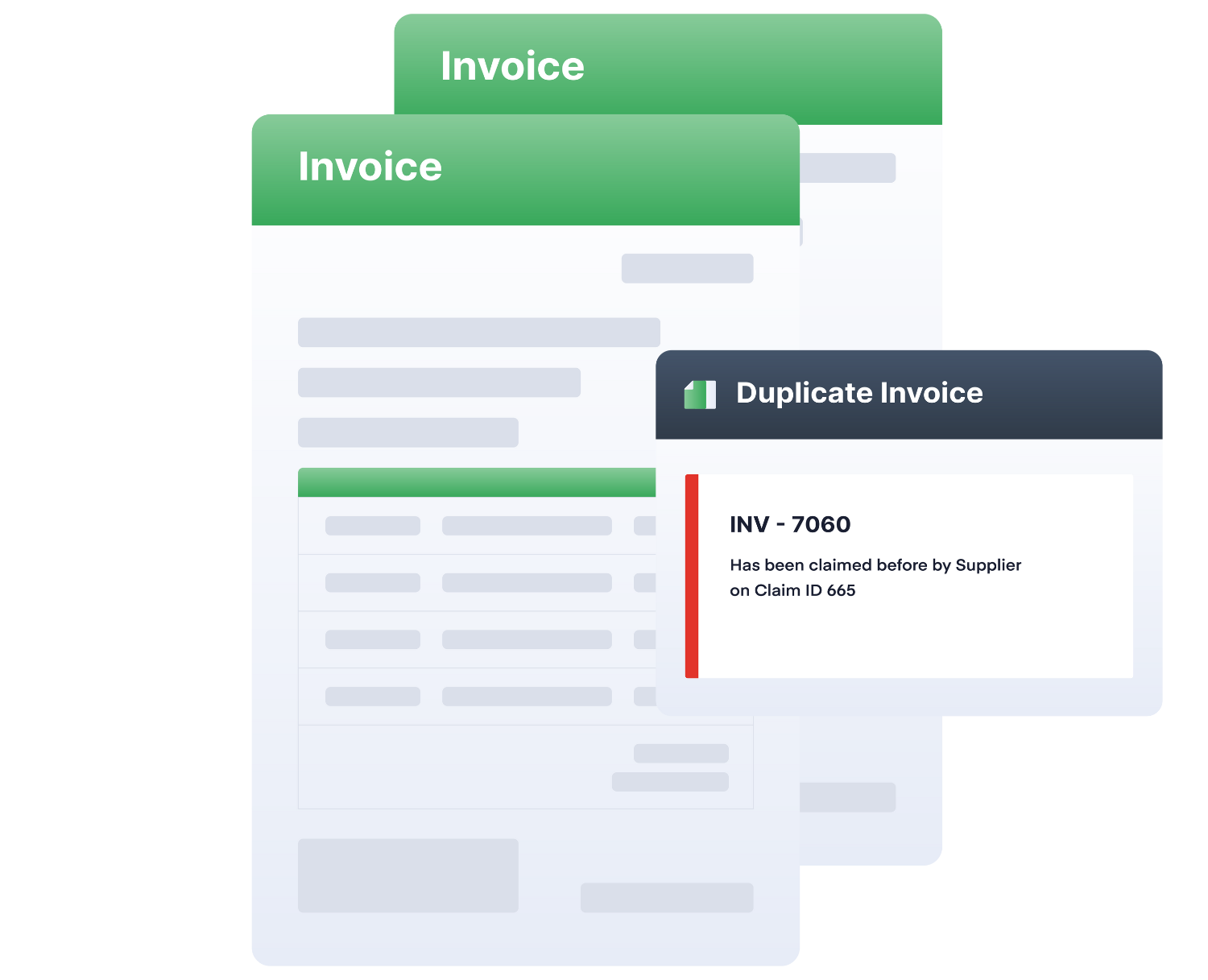

Protect your business from double payments

Duplicate invoices don’t just cost you money. They disrupt your cash flow.

ProSpend’s smart technology automatically scans and compares every invoice to detect duplicates before they're processed.

When a duplicate is found, it’s flagged instantly. You can be confident every payment is accurate and above board.

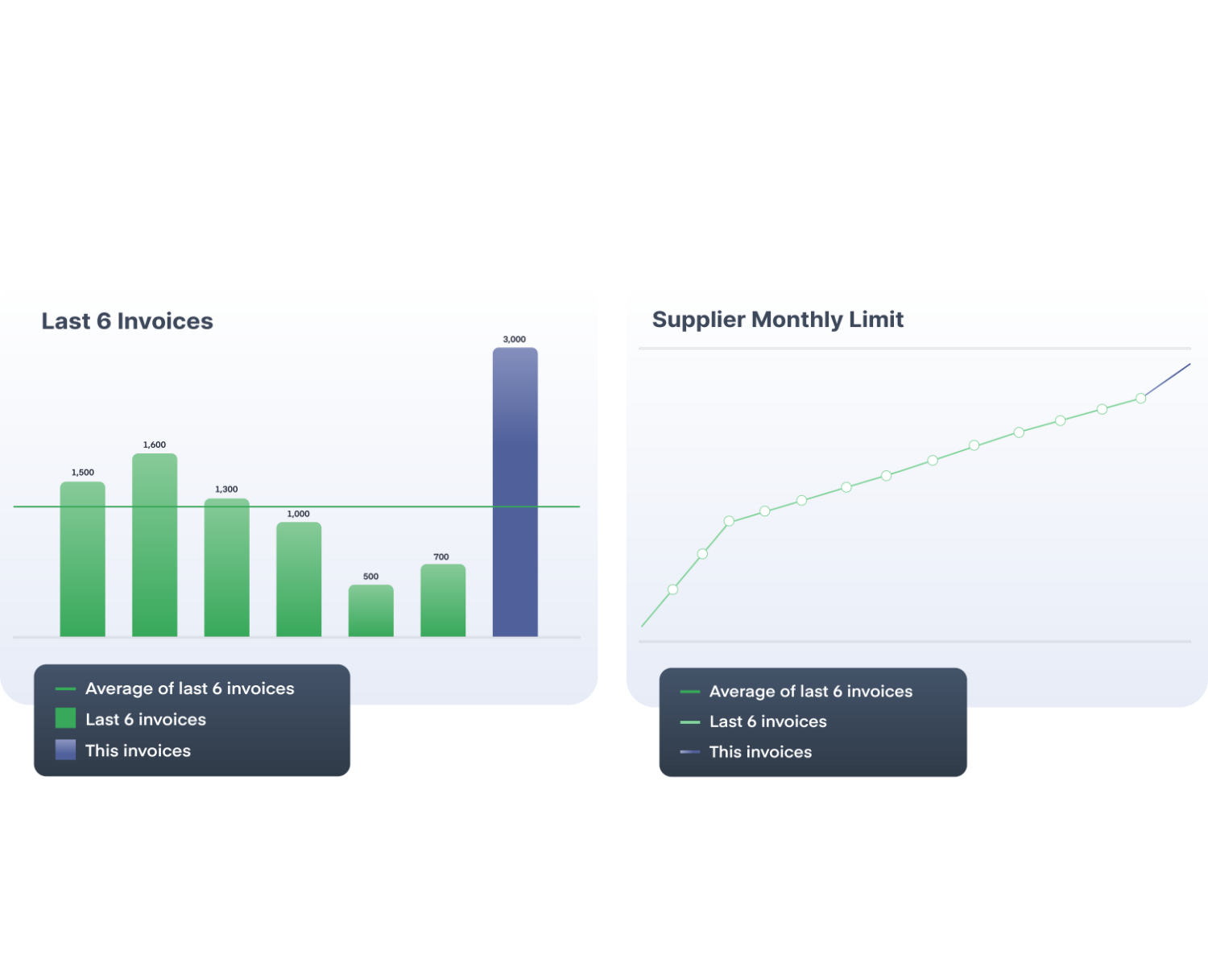

ProSpend spots the unexpected

Our platform doesn’t just process invoices, it understands them.

By learning what’s typical for each supplier, ProSpend can detect anomalies like sudden increases in invoice amounts.

These deviations could indicate fraud, errors, or compromised vendors.

With ProSpend, you’re always one step ahead.

Audit trails ensures accountability

ProSpend provides a complete audit history for every supplier payment, ensuring full visibility and accountability.

From approvals to payment processing, every step is tracked and documented, giving businesses a clear record of actions for compliance and internal reviews.

With detailed insights into every transaction, businesses can verify accuracy, avoid errors, and ensure that every invoice is paid securely and efficiently.

.png?width=1200&height=840&name=homepage%20always%20on%20compliance%20(2).png)

Bank Account Validation

Supplier Average

What our customers say

Join these modern finance teams that trust ProSpend to automate their business spend.

What our customers say

The smartest and most efficient way to manage your spend.

"I believe it is an excellent choice for any organisation seeking a streamlined and efficient AP process."

“The expensemanager (now ProSpend) invoice module has automated our accounts payable process. As a result we have saved hard dollars in printing, filing, storage and man-hours. ”

"We’ve reduced the time to process a supplier invoice approval and payment by a number of days, it’s visible to everyone and now paper-free."

.png?width=52&height=52&name=Baskin%20Robbins%20Logo%20(3).png)

What our customers say

The smartest and most efficient way to manage your spend.

"We’ve reduced the time to process a supplier invoice approval and payment by a number of days, it’s visible to everyone and now paper-free." - Jamie Hughes

“The expensemanager (now ProSpend) invoice module has automated our accounts payable process. As a result we have saved hard dollars in printing, filing, storage and man-hours. ” - Gavin Finn

.png?width=200&height=125&name=Montessori%20Stacked%20(1).png)

"I believe it is an excellent choice for any organisation seeking a streamlined and efficient AP process." Danny Nassif

.png)

ProSpend makes it easy for our staff to submit and approve invoices and claims and capture rceipts. It makes complex workflows simpler.

.png)

We highly recommend ProSpend as an outstanding Accounts Payable (AP) solution for any organisation seeking a streamlined and efficient AP process.

Since implementing ProSpend, we have not only saved on paper costs but also significantly reduced the time managers spend on signing purchase orders.

Friends School

ProSpend makes it easy for our staff to submit and approve invoices and claims and capture rceipts. It makes complex workflows simpler.

Montessori Academy

We highly recommend ProSpend as an outstanding Accounts Payable (AP) solution for any organisation seeking a streamlined and efficient AP process.

Hollard Insurance

As a business with multiple entities, Hollard found ProSpend’s single-database management crucial — improving control, visibility, and operational efficiency.

WestVic Staffing

WestVic Staffing freed up enough capacity to equate to a full-time role — now focused on higher-value, strategic initiatives.

Integrated supplier management

By leveraging an integrated supplier database, ProSpend helps businesses manage supplier relationships more effectively while driving efficiency and accuracy across the board.

-

Integrated database

-

Supplier maintenance

-

Trading term options

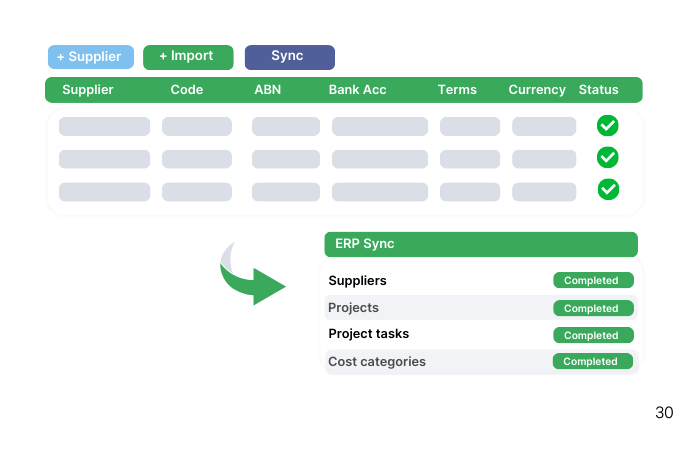

Keep your suppliers in sync

Minimise errors and inconsistencies by maintaining a single source of truth for supplier details.

The database can be maintained easily through a one-off update, import or synchronisation with a range of ERP's

.png)

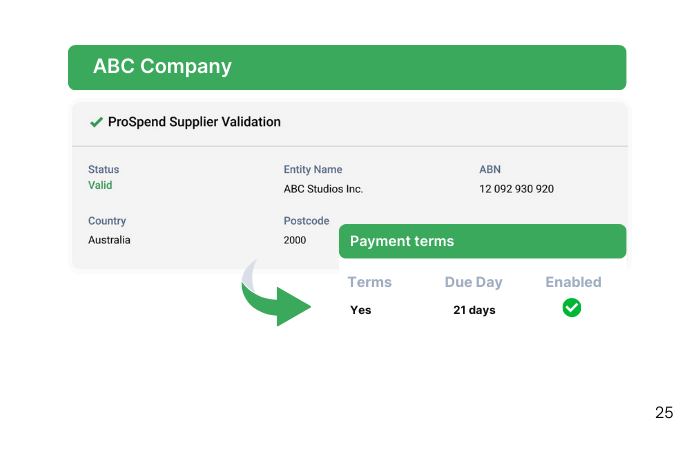

Highly configurable options for suppliers

Full control by AP for supplier maintenance

- Invoice delivery method

- Auto coding - cost centre and g/l code

- Data extraction options

- Payment terms

- Approval workflow

- Currency

- PO Matching

Pay suppliers on your terms

Configure how you want to pay. On scanning the invoice into ProSpend our software will use your preferred configured supplier due date

FAQ

Category 1: Understanding Fraud Control & Invoice Screening

What is invoice screening and why does it matter for ANZ finance teams?

Invoice screening is the automated review of incoming invoices to detect duplicates, suspicious supplier activity, incorrect bank details and anomalies before approval. It protects organisations from payment fraud, overbilling and phishing attempts — issues that are increasingly common across ANZ. Effective screening also reduces reliance on manual checks that are prone to human error.

How does fraud typically occur in invoice processing?

Fraud can occur through fake invoices, altered bank details, duplicate submissions, inflated quantities or shell suppliers. Email-based invoice delivery is a major weakness, as it increases exposure to phishing attacks. Structured screening and validation help teams catch these risks early.

Why are ANZ organisations prioritising fraud controls now?

Because payment redirections, supplier impersonation and email compromise scams have increased across Australia and New Zealand. Organisations with multi-entity setups, decentralised approvals or high invoice volumes are particularly at risk. Strengthening controls helps maintain trust with auditors, boards and funding bodies.

Category 2: How ProSpend Detects & Prevents Fraud

How does ProSpend identify duplicate invoices?

ProSpend examines supplier names, invoice numbers, ABNs, amounts and data patterns to detect duplicates — even when suppliers send variations of the file. Duplicates are blocked before approval, reducing the risk of accidental double payment. This is essential for AP teams handling large volumes or shared inbox setups.

Does ProSpend validate supplier bank details?

Yes. ProSpend checks for changes or anomalies in bank details and stops invoices that require review. This helps prevent payment redirection fraud, which is one of the most common forms of financial crime affecting ANZ organisations.

Can ProSpend flag suspicious or inconsistent supplier behaviour?

Yes. The platform identifies irregular billing trends, mismatched tax amounts, missing ABN details and out-of-pattern invoices. These alerts help finance teams respond quickly before payments are processed.

Does ProSpend help enforce “No PO, No Pay”?

Yes. By ensuring all invoices match an approved purchase order, ProSpend prevents unauthorised spend and reduces opportunities for fraudulent invoices to enter the workflow. This also strengthens procurement compliance.

Category 3: Controls, Compliance & GST Accuracy

How does invoice screening support GST compliance?

ProSpend validates GST amounts, tax categories and ABN details as part of the screening process. This reduces the risk of incorrect GST claims during BAS lodgement and supports clean audit trails aligned with ATO expectations.

How does fraud control help with audit readiness?

Every action is logged, and approvals are backed by structured rules rather than ad-hoc manual checks. Auditors gain clear visibility over why invoices were flagged, approved or rejected. This is especially valuable for NFPs, councils and government-funded entities.

Does ProSpend support multi-entity fraud controls?

Absolutely. Each entity retains its own supplier list, bank details, approval flows and coding rules. ProSpend helps shared-services teams maintain clean boundaries across ABNs, cost centres and project codes.

Category 4: Workflow, Integration & Fit

Does invoice screening slow down AP processing?

No. Screening happens automatically during intake, allowing clean invoices to flow straight through with minimal touch. Only flagged exceptions require review, which reduces workload compared to fully manual checks.

Which ERPs does ProSpend integrate with for fraud control?

ProSpend integrates with Xero, MYOB, NetSuite, Business Central and Acumatica. Validated invoices export cleanly into your ledger with accurate coding, reducing rework and discrepancies.

Is ProSpend suitable for organisations that currently use email-based AP workflows?

Yes. ProSpend replaces email-driven processes with a structured invoice inbox, automated screening and approval routing. This dramatically reduces exposure to phishing and payment redirection scams.

Category 5: Competitive Fit & Supplier Landscape

How does ProSpend compare with Concur, Weel or Lightyear for fraud detection?

ProSpend provides deeper screening tailored to ANZ needs, including ABN validation, GST logic and multi-entity supplier controls. Many organisations choose ProSpend when they need stronger AP fraud prevention and ERP-level integration not available in lighter spend tools.

Will fraud controls still work if suppliers send PDF invoices?

Yes. ProSpend screens OCR-captured PDFs as well as Peppol eInvoices. Both formats undergo validation for bank details, tax, supplier info and duplication.

Do suppliers need to change how they send invoices?

No. ProSpend adapts to your supplier behaviour by supporting PDF, email, upload and eInvoice formats. Suppliers don’t need to onboard or adopt new tools.

One platform for all your business spend

Easily manage your expenses, invoices, purchase orders and cards all in one unified platform

.png)