It’s not new for businesses to make purchases using cards, but gone are the days when they were only limited to physical cards. While both may have the same functions, physical cards and virtual cards have some notable differences.

Physical Card vs. Virtual Card

What is a physical card?

A physical card is a traditional card used for purchases. It contains the cardholder’s name, the 16-digit card number, an expiration date, a CVV and a magnetic strip. As its name suggests, a physical card is a regular plastic card issued by banks for clients to manage their spending.

Clients can use physical cards to withdraw cash from any ATM and make purchases from online and point-of-sale transactions.

What is a virtual card?

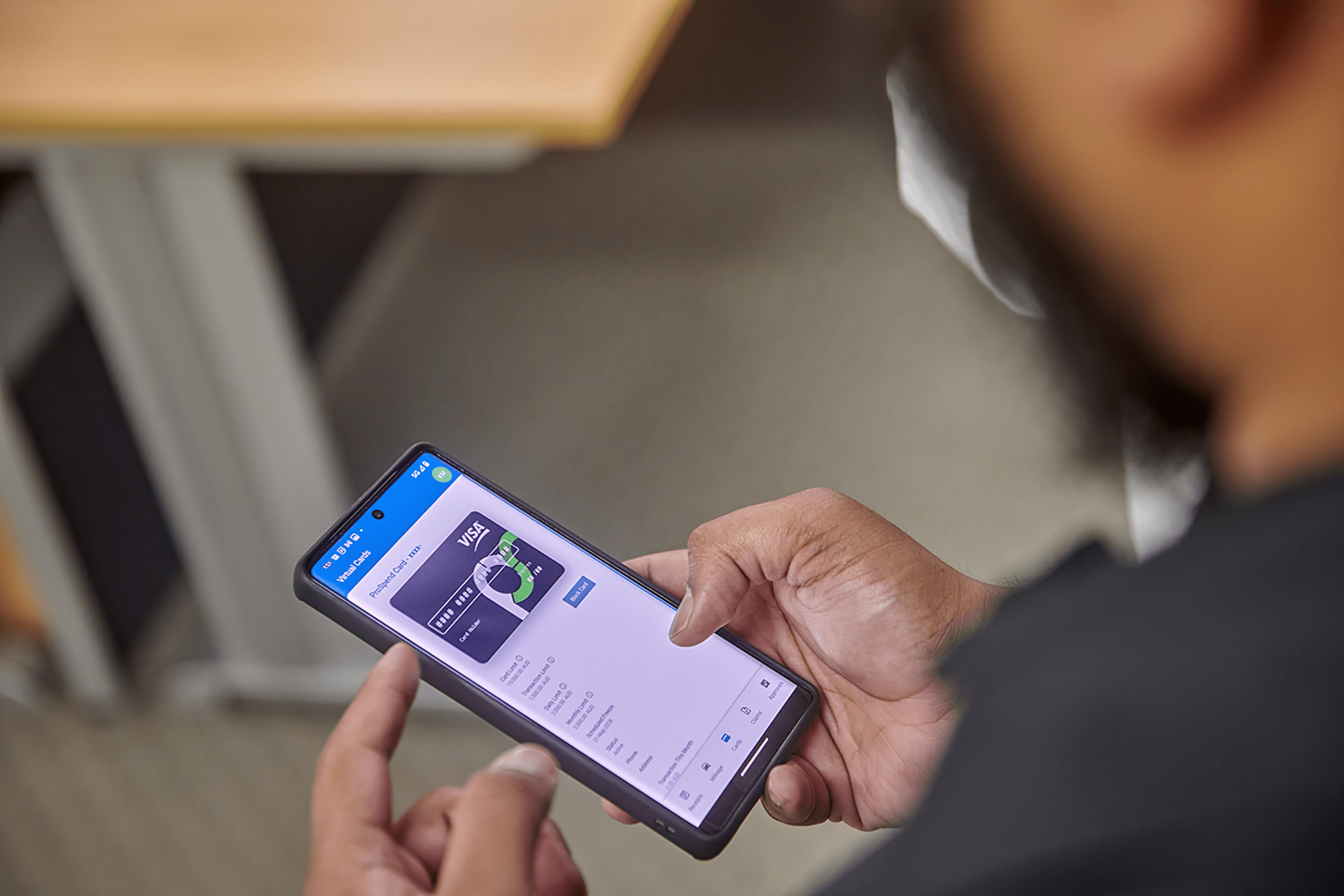

A virtual debit card is essentially a digital version of a physical card. It also comes with a card number, expiration date and CVV. Since it’s a digital version, a virtual card lives in your mobile banking app.

Virtual cards are a digital solution that creates a unique number with every transaction, unlike a physical card that has a fixed card number.

Pros and Cons

Pros and cons of physical cards

Many customers are used to purchasing using physical cards, and while they’re the popular option, they come with their share of pros and cons.

Pros:

- Most merchants worldwide accept physical cards.

- Many users feel reassured by the presence of physical cards, knowing these are tangible and can be kept and hidden.

- With a physical card, you can withdraw cash from any ATM—unlike with a virtual card which you can only use on contactless-enabled ATMs.

- Physical cards are more convenient for customers without smartphones.

- Your physical card doesn’t rely on your phone, so you can still make purchases even if your phone battery dies.

Cons:

- Physical cards can be stolen and are more vulnerable to scams.

- It can take weeks for a physical card to be ordered and delivered.

- You can’t easily configure limits such as selecting a date to automatically freeze your card or applying rules that restrict it from working for particular industries and/or currencies.

- They’re not environment-friendly.

- A physical card is another thing you have to bring each time—unlike a virtual card that you can easily access through your phone.

Pros and cons of virtual cards

Since virtual cards are a fairly new way to make payments, it’s understandable that some customers still feel unsure about getting into them. Here are the pros and cons of virtual cards that may help you with your decision.

Pros:

- You can have a virtual debit card for just one specific transaction or amount. This ensures that you get to control how much you spend and you get to protect your primary card.

- You can run and manage your entire company cards program yourself with greater control—no need to rely on a bank to do simple things like creating a new card or reactivating an existing one.

- Creating a virtual card is quick and easy. Waiting for your card to arrive is now a thing of the past.

- Virtual cards are more secure. With single-use virtual cards, the card number is only valid for a single transaction, so if it gets compromised, it can’t be used for any other purchases.

- Individual cards can be set up for each business subscription, so you can easily manage subscriptions and vendor payouts.

- You can be issued with an unlimited number of cards.

Cons:

- You can only use virtual cards for online purchases.

- Virtual cards rely on the issuing bank’s technology, so if the latter is having system issues, your virtual card may not work.

- Some merchants may not accept payments through virtual cards.

- It may be difficult to trace who initiated each transaction.

- Virtual cards can be easily accessed by every employee.

Choosing the Card for Your Business

If you’re currently using a physical card for your business and thinking of switching to a virtual card, check out this guide.

Uses of virtual cards for business

1. Petty cash fund upgrade

It can be pretty taxing to upgrade your business’s petty cash fund using a physical card or cash. Upgrading your fund through digital means is not just convenient; it also allows for better traceability of where the funds are being spent and by whom—especially in comparison to cash.

2. Monitoring of campaigns and subscriptions

Your company may be using some tools that you pay for monthly or annually. With virtual cards, you can set up individual cards for each subscription with a specific limit. This will ensure that the deducted amount doesn't automatically increase and it won’t be a surprise hit for your cash flow. This is also to prevent double dipping.

3. Improved security

You can set up your virtual card to prevent unauthorised transactions and block certain merchant categories. Virtual cards are also usually used only once, so they won’t be appealing to scammers and thieves.

4. Controlled spending

This is especially helpful for organisations that are trying to cut costs and manage expenses. With virtual cards, you can track transactions and data in real-time.

5. Accountability

Each transaction that has been made and will be made is labelled and categorised when you use a virtual card because virtual cards offer visibility for transactions.

6. Business transactions

With virtual cards, employees can submit requests for cards where they itemise beforehand exactly what they need the card for, such as for a trip.

7. Vendor management

You can easily manage your vendors because you can create virtual cards based on the number of vendors that the business has. You can easily see how many vendors you have across all departments, as well as how much money has been spent.

With our ProSpend cards, we offer greater flexibility, control, convenience, speed and security. We recommend going for a virtual debit card rather than a virtual credit card so you could easily manage your spending.

Thinking of getting a virtual card for your business? Book a demo with us.