Virtual Cards – The Smarter Alternative

Start controlling business spend the proactive way. Issue cards instantly, control the spend and track transactions in real-time.

Over 1,000 customers trust us since 2015

Integrations with 30+ leading ANZ ERPs

Dedicated implementation and local support

MYOB Innovative App of the year finalist

Smart, secure cards with built-in spend control

✅ Instant issue ✅ Configure and control spend ✅ Real-time transactions ✅ Automatic claim creation

Ready to see how it works

Check out the video now!

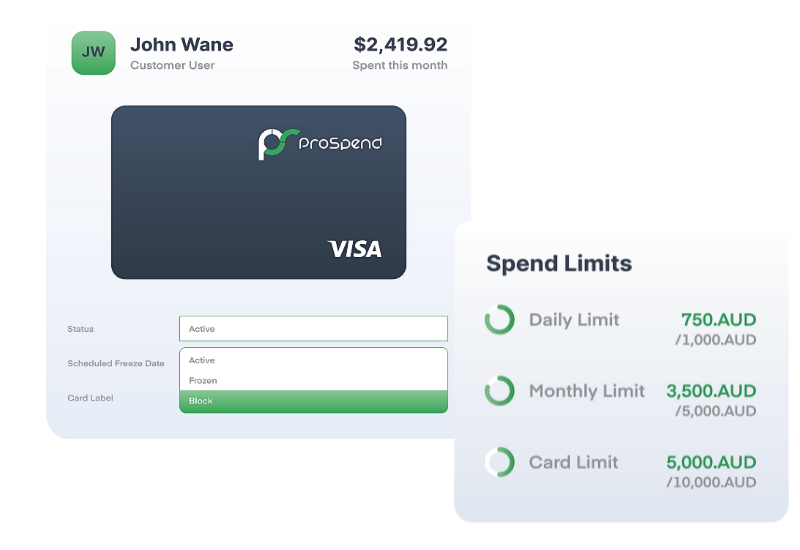

Instantly issue your own cards

Built right into a tried-and-tested comprehensive business spend management system, you’ll have the power to issue, block, edit, track and reconcile cards instantly within the ProSpend platform - ideal for replacing reimbursement and traditional card programs and no more waiting for cards to be sent.

And no more waiting for statements, you can see transactions and monitor card limits in real time by team, individual, and entities, all in a single console to increase accountability.

.png?width=800&height=550&name=issue%20virtual%20card%20(1).png)

Use to pay easily

Once issued, the cards can be easily added to Apple Pay and/or Google Wallets for making contactless payments. They can also be used for online payments and over-the-phone transactions.

With the spending control limits that can be customised and configured down to individual users.

Configure and control spend

Each card can be uniquely tailored to its user when it's active, with a range of options and rules, including:

✅ Per transaction spend limits

✅ Weekly, monthly or lifetime limits

✅ Active limits

✅ Currency

.png?width=1200&height=825&name=fraud%20virtual%20card%20(2).png)

Safe, secure and transparent

✅ Administrators can block, freeze and cancel cards instantly.

✅ Spend safely online without the risk of card fraud or theft. Your spending is protected by Visa, Apple Pay and Google Pay fraud systems

✅ The days of card sharing and fraud risk are over. Issue cards for subscriptions or one-off expenses.

Manage your subscriptions easily

.png?width=1200&height=825&name=subscription%20management%20(1).png)

Fuzzy Events

Hear how ProSpend helped Fuzzy Events manage their unique challenges with the events industry and how ProSpend virtual cards were a game changer.

.png?width=1200&height=800&name=fuzzy%20events%20(5).png)

.png?width=1200&height=825&name=physical%20cards%20(1).png)

When you need to tap

Our physical cards ensure your employees are never left stranded when transacting in remote areas where digital payment infrastructure is still developing.

Explore all the features of Virtual Cards

Virtual Cards include free subscription to our leading expense management platform.

Card and Reimbursements

Edit, submit and approve all claim typesp

Receipt Capture

Snap a receipt with OCR scanning for data entry

Mileage Claims

Mileage claim creation with google maps

Approvals On the Go

Approve or reject claims anywhere, anytime

One platform for all your business spend

Easily manage your expenses, invoices, purchase orders and cards all in one unified platform

FAQ

Category 1: Understanding Virtual Cards

What are virtual cards and how do they work for business spend?

Why are virtual cards becoming popular in Australia and New Zealand?

Do virtual cards replace corporate credit cards?

Category 2: Controls, Security & Compliance

How do virtual cards improve spend control?

Each card can be restricted by budget, time period, supplier or department. This removes ambiguity and ensures employees can only make approved purchases. It supports pre-spend governance similar to purchase orders.

Are virtual cards more secure than traditional cards?

Yes. Virtual cards prevent card sharing, reduce exposure to fraud and allow immediate cancellation without impacting other payments. They also help organisations comply with internal security policies and reduce risk from phishing or compromised suppliers.

How do virtual cards support GST accuracy?

Category 3: How ProSpend Virtual Cards Work

How are virtual cards issued in ProSpend?

Finance or budget owners can instantly issue virtual cards to staff or for specific suppliers. Each card has predefined rules around budget, category and approval requirements. This gives complete visibility of spending before it occurs.

Can virtual cards be limited to specific suppliers or subscriptions?

Yes. ProSpend allows single-use or recurring subscription cards, helping teams manage SaaS renewals and vendor-specific spend. This reduces the risk of forgotten subscriptions and unauthorised recurring charges.

Does ProSpend support receipt capture for virtual card spend?

Yes. Staff upload receipts on web or mobile, and ProSpend automatically matches them to the correct transaction. This improves compliance, reduces month-end chasing and keeps GST records accurate.

Category 4: Integrations, Implementation & Fit

Which ERPs do ProSpend Virtual Cards integrate with?

ProSpend exports transactions directly into Xero, MYOB, NetSuite, Business Central and Acumatica with correct coding. This keeps reconciliation simple and avoids manual entry across multiple entities.

Can virtual cards be used in multi-entity organisations?

Absolutely. Each entity can have its own card rules, budgets and cost centres. Shared-services teams gain central oversight while maintaining strict separation of spend.

How long does it take to set up virtual cards?

Most organisations go live quickly, as setup involves configuring card rules, user access and ledger mapping. Implementation is guided by Australian-based support teams and typically aligns with broader AP and expense rollout.

Category 5: Pricing, Support & Competitive Fit

How are ProSpend virtual cards priced?

Pricing varies based on card usage volume, entities and whether the organisation is using ProSpend’s broader platform (Expenses, AP, POs). Many NFPs and councils receive tailored pricing aligned to their usage patterns.

How does ProSpend compare to Airwallex, Weel or TrailD for virtual cards?

ProSpend is designed specifically for ANZ finance teams needing strong policy controls, expense reconciliation and ERP integration. Unlike lighter tools, ProSpend connects card spend with approvals, budgets and GST workflows across the entire finance stack.

Can virtual cards replace petty cash and reimbursements?

In many cases, yes. Virtual cards allow employees to pay directly for approved purchases, removing the need for petty cash, manual reimbursements and excess card sharing.

What support is available after rollout?

ProSpend provides ongoing Australian-based support, training and account management. Most teams handle card controls and user changes internally after implementation.

Quick and reliable payments when you need to tap

Give your employees ProSpend physical cards with built-in spend control and security features