eInvoicing; a digital strategy

ProSpend can fast-track your digital transformation with our eInvoicing module and receive your supplier invoices digitally. Our feature-rich, secure eInvoicing solution is the smarter way to increase efficiency, accuracy and security

Over 1,000 customers trust us since 2015

Integrations with 30+ leading ANZ ERPs

Dedicated implementation and local support

MYOB Innovative App of the year finalist

What it is and how it works

In the simplest terms, eInvoicing allows the seller to create and send an invoice from their software, through the eInvoicing network straight into the buyers software.

Automatic exchange of invoice data

eInvoicing (sometimes known as electronic invoicing) is the automated exchange of structured invoice data directly between senders and receiver’s software across a highly secure, governed network.

In the simplest terms, eInvoicing allows the seller to create and send an invoice from their software, through the eInvoicing network straight into the buyers

software.

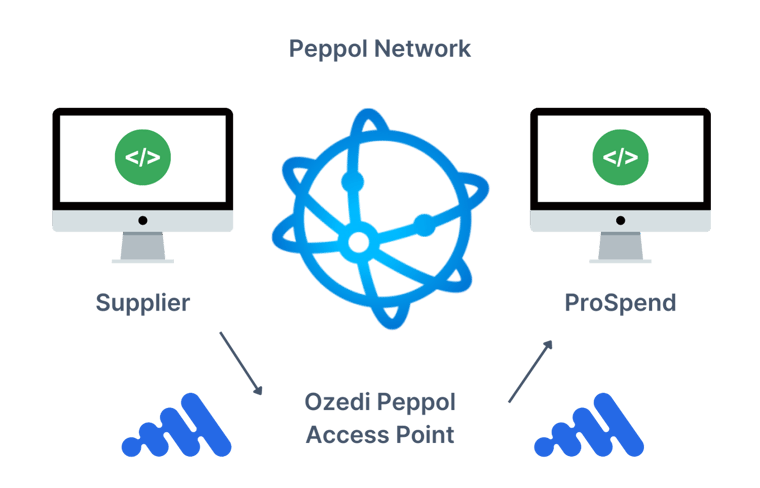

ProSpend has partnered with Ozedi as their Peppol Access Point for the receipt of invoice/date through the Peppol Network

The Peppol Network

Peppol was created by OpenPEPPOL in 2008 to set the standard for eInvoicing and other eDocuments.

The Peppol framework outlines the Peppol UBL (Universal Business Language) format for these documents and it governs the Access Point network.

This framework is currently used in over 34 countries including Australia, New

Zealand and many countries throughout Europe and Asia.

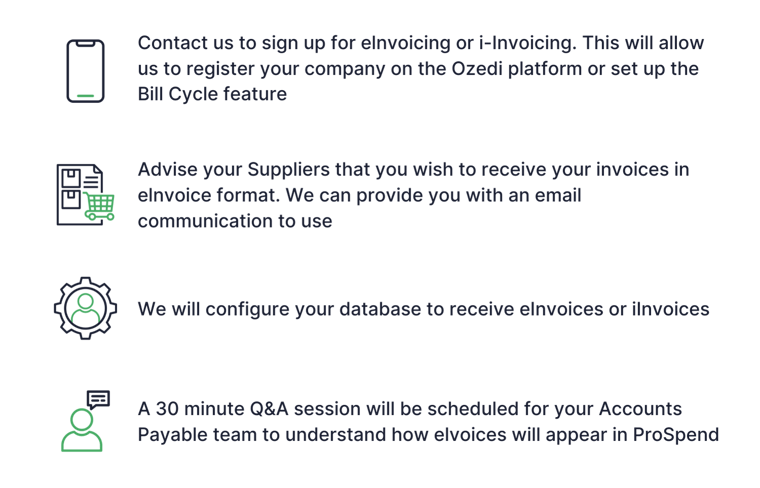

How we help

ProSpend offers our clients a setup service to enable einvoice.

We will assist you in advising your Suppliers you are eInvoice ready and configure your database.

A 30minute Q&A session is scheduled for finace teams to understand how eInvoices will appear in ProSpend.

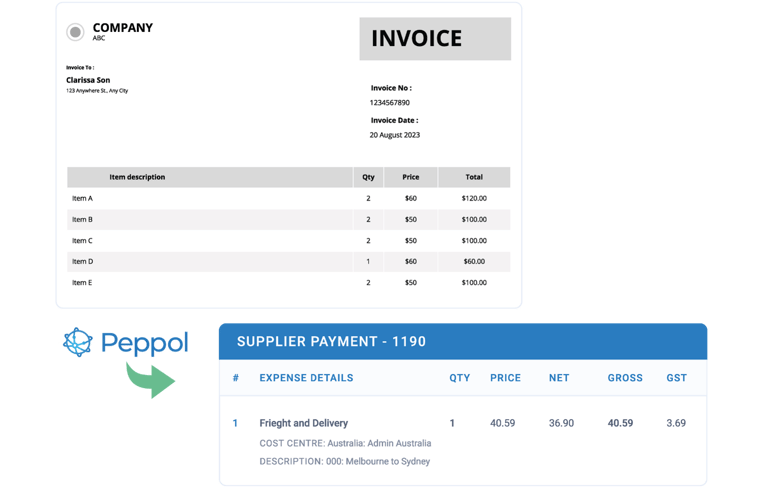

The data is better

The following line data will be the standard delivery. ProSpend can be configured so the supplier payment request can be created as a header only or multi-line.

Additional data can be imported based on the output from each supplier and custom data

fields can be configured on request.

.png?width=800&height=550&name=line%20item%20scanning%20(8).png)

Explore all the features of e-invoicing

Minimise fraud and billing scams

Under the Peppol network invoices are sent in the same predefined format with encryption and strict security significantly reducing the possibility of it being altered in any way.

Sending and receiving invoices directly through the network via the approved and accredited Access Points, means it reduces the risk of fake invoices and scams to virtually nil.

.png)

Get paid faster with system to system delivery

- Eliminate errors and less administration

- Know where your invoices are with enhanced traceability

- Know when your invoices have been received and actioned

- Federal Government agencies are paying eligible eInvoices within five days

eInvoicing 101

Benefits for the Australian Economy

Samantha Coloe, Assistant Director - eInvoicing at the Australian Taxation Office (ATO), is a leader in digital transformation and set up of initiatives that benefit the Australian economy.

In this webinar she talks about what eInvoicing is, and what it isn't, the benefits of eInvoicing, it's uptake and more insights that can help you better understand the need for eInvoicing.

eInvoice delivery plus ProSpend powerful accounts payable automation

Our eInvoice module is backed by our powerful accounts payable automation that includes an integrated supplier database and unmatched features including Supplier Average and Bank Account Validation.

Always on compliance

.png?width=800&height=550&name=audit%203%20(2).png)

Always on compliance

ProSpend’s platform provides audit trails for every transaction, making compliance verification straightforward and transparent for administrators and auditors.

Spending limit alerts, mandatory data fields, and automated approval workflows ensure employees and approvers know exactly what they can spend and approve, eliminating any confusion.

Coding & matching completed

.png?width=800&height=550&name=invoice%20scanning%20(1).png)

Coding & matching completed

Intelligent automation so invoices are to automatically coded and supplier matched and and approval workflows and matched to PO’s.

Duplicate invoice check

.png?width=800&height=550&name=duplicate%20payment%20(10).png)

Duplicate invoice check

Duplicate invoice checking is done and validation against a checklist of configured rules reducing errors.

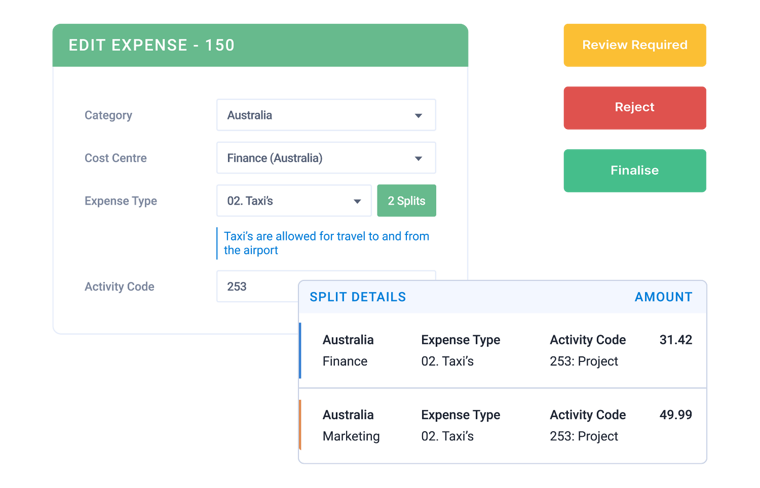

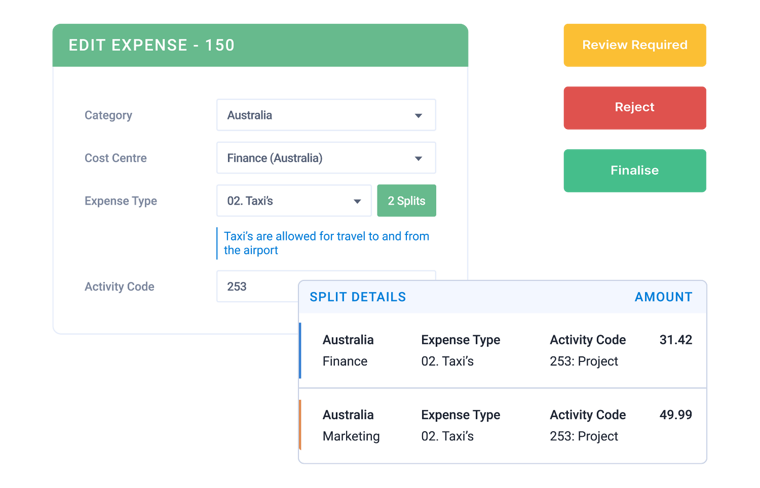

Quick split allocations

Quick split allocations

Easily split invoice amounts across multi-entities, cost centres, tracking and general ledger codes with a favourite split wizard for automatic splits.

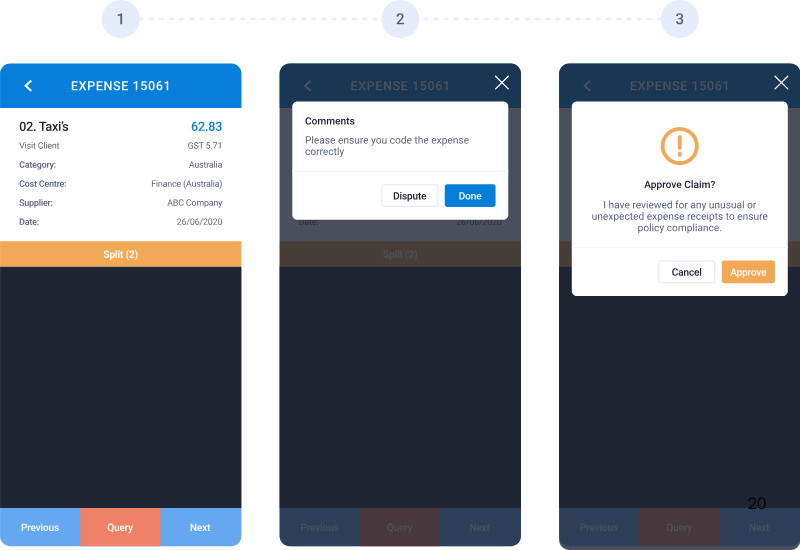

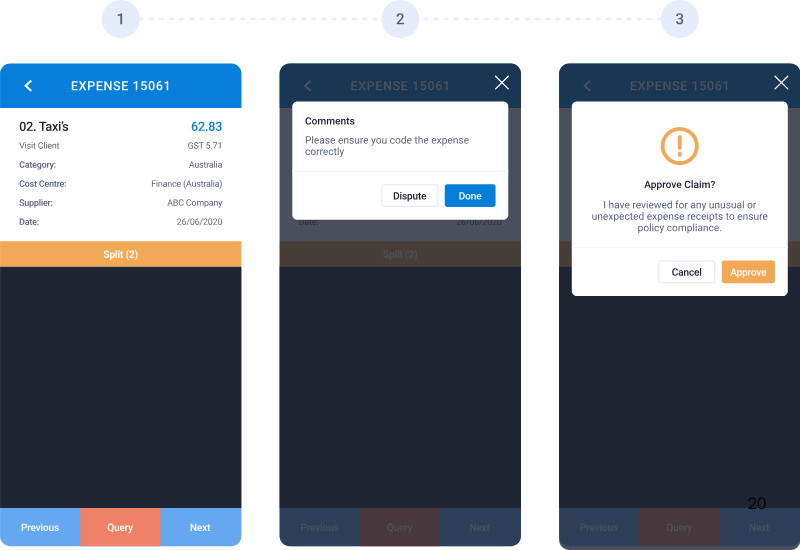

Coded invoices sent to approvers

Coded invoices sent to approvers

Approvers receive fully coded invoices and can approve on the go. Multi-level approval workflows with configurable limits can be set up to the company policy.

.png?width=800&height=550&name=audit%203%20(2).png)

Always on compliance

ProSpend’s platform provides audit trails for every transaction, making compliance verification straightforward and transparent for administrators and auditors.

Spending limit alerts, mandatory data fields, and automated approval workflows ensure employees and approvers know exactly what they can spend and approve, eliminating any confusion.

.png?width=800&height=550&name=invoice%20scanning%20(1).png)

Coding & matching completed

Intelligent automation so invoices are to automatically coded and supplier matched and and approval workflows and matched to PO’s.

.png?width=800&height=550&name=duplicate%20payment%20(10).png)

Duplicate invoice check

Duplicate invoice checking is done and validation against a checklist of configured rules reducing errors.

Quick split allocations

Easily split invoice amounts across multi-entities, cost centres, tracking and general ledger codes with a favourite split wizard for automatic splits.

Coded invoices sent to approvers

Approvers receive fully coded invoices and can approve on the go. Multi-level approval workflows with configurable limits can be set up to the company policy.

FAQ

Category 1: Understanding eInvoicing in ANZ

What is eInvoicing and how does it work in Australia and New Zealand?

eInvoicing is the secure, standardised exchange of invoices between systems through the Peppol network, without PDFs or email attachments. In Australia and New Zealand, it’s supported by the ATO and MBIE to reduce fraud, improve accuracy and speed up AP processing. It ensures invoices arrive directly into your finance system in a validated, structured format.

Why are organisations in ANZ shifting to eInvoicing?

Because it eliminates manual data entry, reduces errors, shortens payment cycles and improves supplier relationships. Councils, NFPs, government-funded services and mid-market organisations increasingly adopt eInvoicing to meet transparency expectations and modernise AP. It also significantly reduces exposure to fake invoices and email-based scams.

Do suppliers need to be registered for eInvoicing?

Yes — both the sender and receiver must be registered on the Peppol network. Once connected, invoices are exchanged instantly and securely. Many ANZ suppliers are rapidly onboarding to meet government-driven adoption targets.

Category 2: How ProSpend Supports eInvoicing

How does ProSpend receive eInvoices?

ProSpend receives eInvoices directly through the Peppol network and converts them into AP-ready transactions. Coding, GST validation and invoice fields are auto-populated, reducing manual verification. The invoice then flows seamlessly into approval workflows and your connected ERP.

Does eInvoicing replace OCR for invoice capture?

Not entirely — eInvoicing complements OCR rather than replaces it. While Peppol invoices arrive perfectly structured, many suppliers still send PDFs, meaning OCR remains useful. ProSpend supports both pathways to ensure complete invoice coverage.

Can ProSpend match eInvoices to purchase orders?

Yes. eInvoices follow the same matching rules as any other invoice. ProSpend can perform 2-way and 3-way matching, ensuring quantity, price and supplier details align with your POs and receipts.

Category 3: Compliance, Security & Risk

Is eInvoicing more secure than email-based invoicing?

Significantly. eInvoicing reduces the risk of invoice fraud, spoofing, incorrect bank accounts and phishing attacks common with PDF invoices. Because invoices are exchanged system-to-system via Peppol, they bypass inboxes entirely.

How does eInvoicing support GST accuracy?

Because eInvoices arrive with structured tax details, GST coding is far more accurate. This helps reduce BAS adjustments and ATO queries, especially for multi-entity organisations managing thousands of invoices. ProSpend adds further validation to ensure tax codes are applied correctly.

Is eInvoicing mandatory in Australia?

Not yet for the private sector, but the ATO strongly encourages adoption. Many government departments and agencies already require or prefer eInvoicing. ANZ businesses benefit from lower processing costs and faster payment cycles.

Category 4: Implementation & Integrations

How long does it take to enable eInvoicing in ProSpend?

Most organisations enable eInvoicing within a few weeks, as configuration is lightweight. Implementation includes network registration, mapping fields and end-to-end testing. Australian-based support teams guide the process throughout.

Which ERPs does ProSpend integrate with for eInvoicing?

ProSpend integrates with Xero, MYOB, NetSuite, Business Central and Acumatica. eInvoices are automatically coded and exported into the correct ledger, cost centre and tax treatment.

Can eInvoicing work across multiple entities?

Yes. ProSpend supports separate entity registrations and maps inbound eInvoices to the correct ABN or NZBN. This is especially valuable for groups managing multiple business units under shared AP.

Category 5: Supplier Adoption & Fit

What if only some of our suppliers use eInvoicing?

That’s common. ProSpend supports hybrid capture — eInvoices flow via Peppol while PDF invoices are processed via OCR. This ensures your team benefits immediately without waiting for full supplier adoption.

Will eInvoicing speed up supplier payments?

Yes. Cleaner data, instant delivery and fewer exceptions lead to earlier approvals. This helps ANZ organisations meet supplier payment expectations, especially those aiming for 10–14 day payment windows.

How does ProSpend compare to Airwallex, Lightyear or Weel for eInvoicing?

ProSpend offers deeper integration with ANZ ERPs, multi-entity logic and PO + matching capabilities. Many finance teams choose ProSpend when they need a fully connected AP ecosystem rather than a standalone capture tool.

One platform for all your spend

Easily manage your expenses, invoices, purchase orders and cards all in one unified platform