Losing 20 hours a month to invoice processing?

Designed for ANZ mid-market finance teams, ProSpend's Australia-built AP automation software reduced invoice processing times by over 60% and stops invoice fraud in real-time.

The Smarter Way to Manage Employee Expenses

Built for ANZ mid-sized finance teams, ProSpend Expense Manager replaces spreadsheets with real-time spend visibility, mobile capture and approvals, and stronger FBT/GST compliance without losing control.

Trusted by ANZ finance teams

Join 1,000+ Australian and New Zealand organisations that trust ProSpend, including RSL NSW, Monash College, Baskin‑Robbins, The Friend’s School, and more.

Why mid-market ANZ finance teams choose ProSpend for expense management

One platform for all spend

Expenses, AP invoices, purchase orders, corporate cards, and travel in one system for a complete view of business spend.

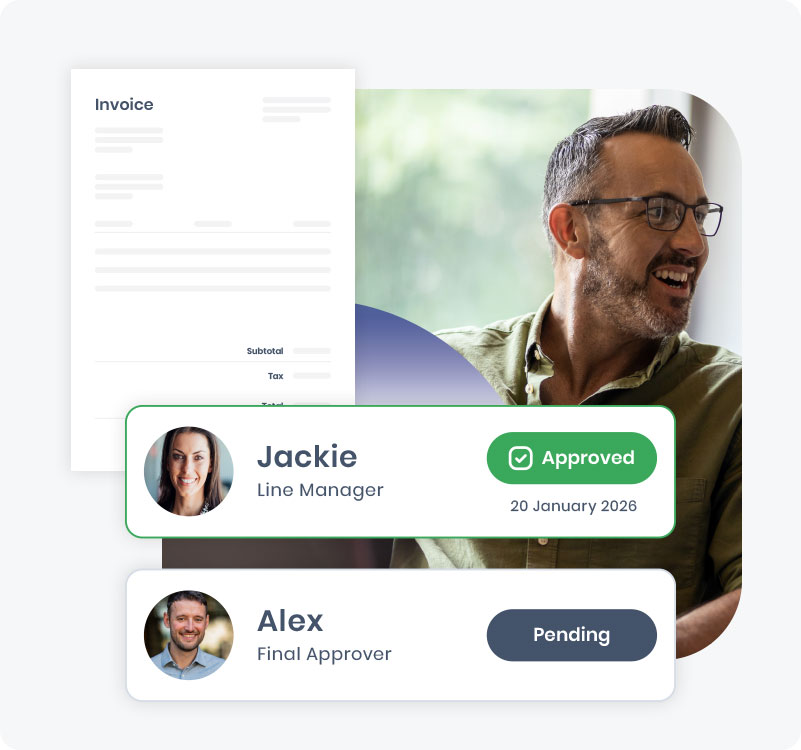

Fast mobile approvals

Managers approve or query in seconds via mobile or email so every action is timestamped and visible to finance.

Corporate card reconciliation, daily

Match transactions to receipts, flag missing receipts early, and reduce month-end scramble.

GST & FBT-ready workflows

Capture the context and evidence finance teams typically need to handle GST and FBT consistently.

Seamless multi-entity control

Manage multiple entities with entity-specific policies and consolidated reporting.

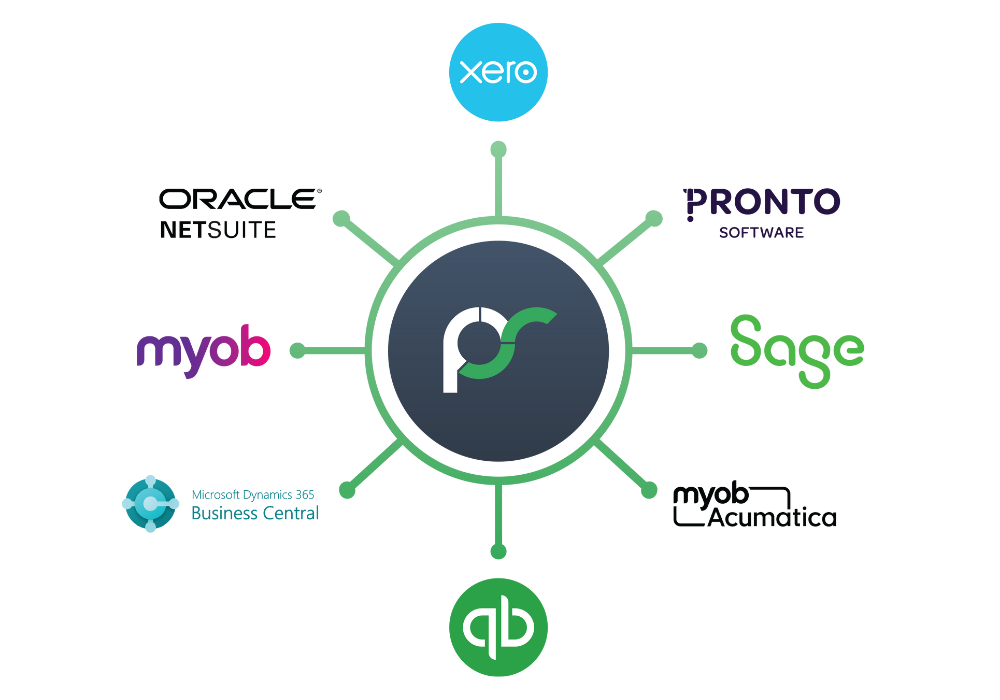

Integrates with your finance stack

Built for Xero, MYOB, NetSuite, Dynamics 365 Business Central, Acumatica and more. Approved expenses sync with coding + attachments.

Still doing expense reports in spreadsheets and chasing receipts?

Manual expense reports and spreadsheet claims create the same pain every month: late receipts, slow approvals, inconsistent coding, and stress at month-end and audit time. Employees dread the admin, managers delay approvals, and finance ends up chasing missing information.

With ProSpend, you can finally break this cycle:

Cut processing time by removing re-keying and manual routing

Speed up approvals and reimbursements with mobile-first workflows

Enforce policy automatically (missing receipts, exceptions, out-of-policy spend)

See spend in real time before reimbursement and before posting

Experience it visually

See how ProSpend transforms expense management from piles of paper to a streamlined digital process.

Invoices entered once—no manual typing ever again

Our AI-powered invoice scanning and extraction instantly reads even the most complex invoice formats, automatically extracting and validating data. No templates or manual entry required, just clean, accurate invoice data flowing seamlessly into your workflows.

Our machine learning-powered engine has been trained on millions of supplier invoices delivering exceptional first-time accuracy.

.png?width=600&height=180&name=bto2%20(2).png)

Get 100% accuracy, verified by local experts

ProSpend has been a market leader in delivering an uncompromising invoice extraction service with HITL.

HITL machine learning can be thought of as attended machine learning and it allows us to guarantee 100% accuracy on invoice data extraction. Without the HITL model, every time an exception is received it will require manual data entry by the finance team and because the machine is not trained, low accuracy rates will continue.

That’s just not a complete service. Document exceptions are handled by ProSpend within our end-to-end process and this process is managed entirely by our team.

"ProSpend delivers a system that achieves the perfect harmony between the work of machines and that of people; the more you use it, the smarter it gets."

%201500px%204.png?width=1500&height=1000&name=ProSpend%20Human-In-The-Loop%20(HITL)%201500px%204.png)

.png?width=1200&height=825&name=duplicate%20invoice%20(2).png)

Protect your business from double payments

Duplicate invoices don’t just lead to overpayments, they can seriously impact your cash flow.

ProSpend’s advanced technology automatically scans and compares every invoice, detecting duplicates before they’re processed.

If a duplicate is detected, it is flagged instantly, giving you confidence that every payment is accurate and justified.

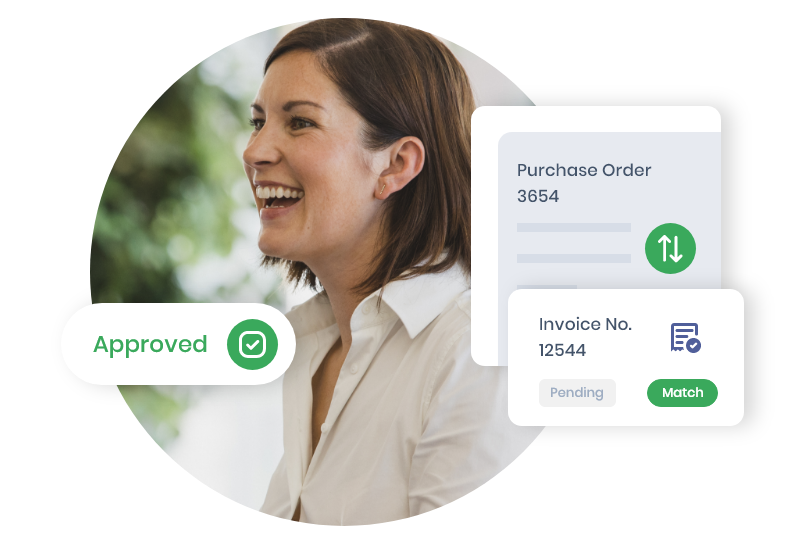

Invoice coding that eliminates errors instantly

Ensure fast and error-free processing with ProSpend's configurable coding. Each invoice is automatically verified against your your guidelines, with supplier matching, coding rules applied, PO matching, and approval rules enforced. This automation reduces errors and accelerates processing times.

.png?width=600&height=180&name=bto2%20(2).png)

.png?width=1200&height=825&name=2%20way%20matching%20(2).png)

.png?width=1200&height=825&name=line%20item%20scanning%20(11).png)

Invoice details, captured accurately every time

ProSpend offers either header or line-item OCR data extraction.

Line item extraction takes invoice processing to the next level by capturing detailed information at the line-item level.

This means every product, service, quantity, and price is accurately extracted and coded, providing complete transparency and control over your spending.

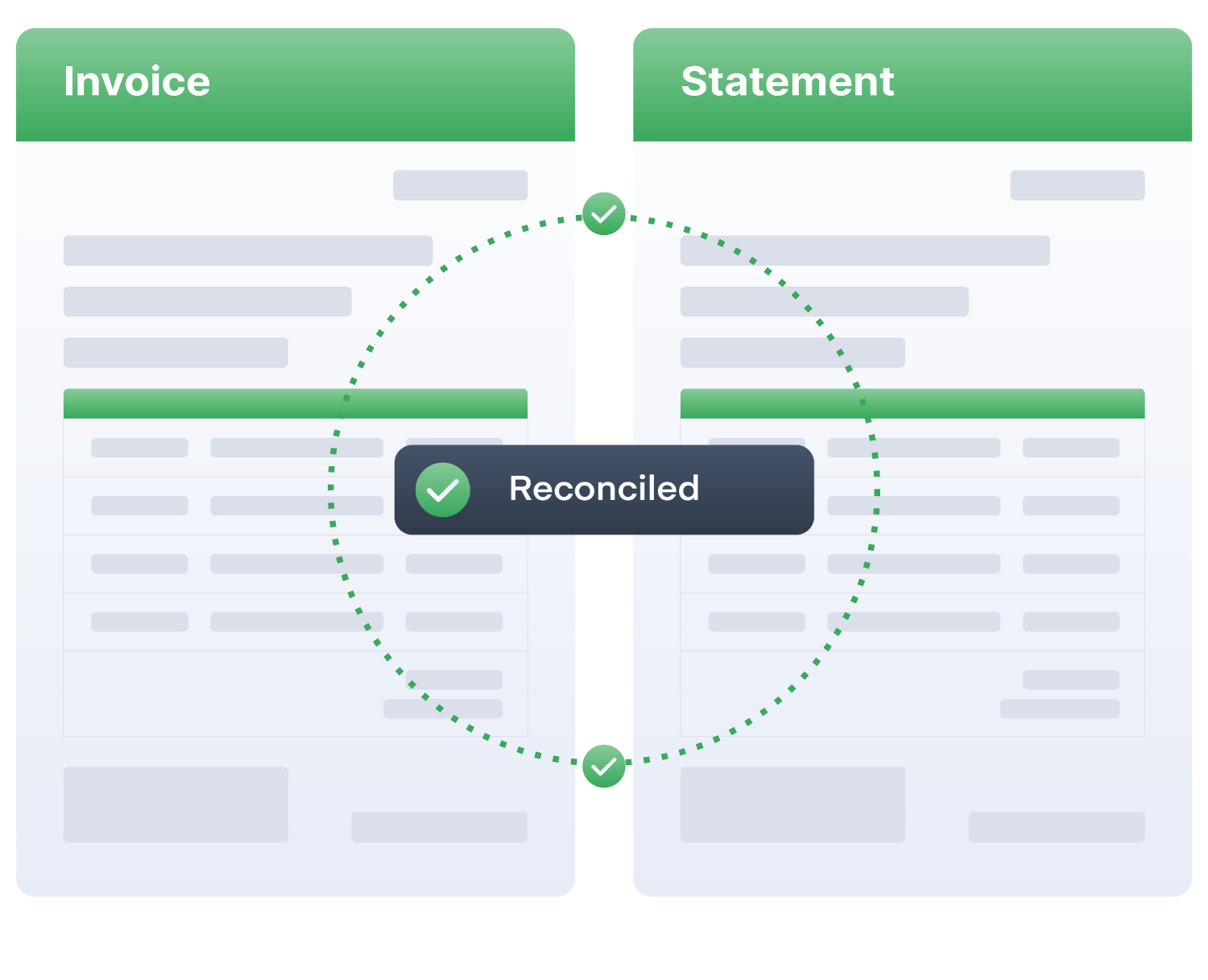

Every supplier reconciled, not just your top 10

Why reconcile just your top suppliers when you can reconcile them all?

With ProSpend’s Statement Reconciliation, you can eliminate the manual processes that limit businesses to reconciling only their largest suppliers.

Our solution enables full visibility across your entire supplier base, while strengthening financial controls and improving supplier relationships.

Bank Account Validation

Supplier Average

Over 1,000 ANZ businesses trust ProSpend since 2015

Join these modern finance teams that trust ProSpend to automate their invoice management.

.png)

We have found ProSpend to be a significantly more efficient and effective approach to our purchasing and expense processing and has proven to be well worth the investment.

.png)

We highly recommend ProSpend as an outstanding Accounts Payable (AP) solution. We believe it is an excellent choice for any organisation seeking a streamlined and efficient AP process.

.png)

With ProSpend our managers have better visibility and control along all the steps of the invoice entry, approval and payment process and their year to date spend against budget, with no need to wait for EOM reports.

ProSpend's PO and invoice module matched our needs perfectly. It helped users create POs, route them through the approval process, and automatically match approved POs to incoming invoices. With ProSpend, we cut AP invoice processing time by 50%.

Stop invoice fraud in its tracks

ProSpend uses OCR and AI technology to scan every invoice and the data extracted initiates a rigorous multi-check process.

Errors and anomalies are identified immediately, giving your business protection from fraud and payment mistakes.

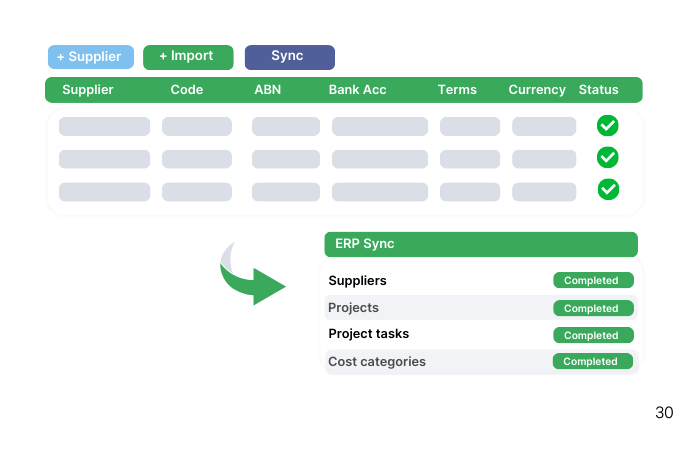

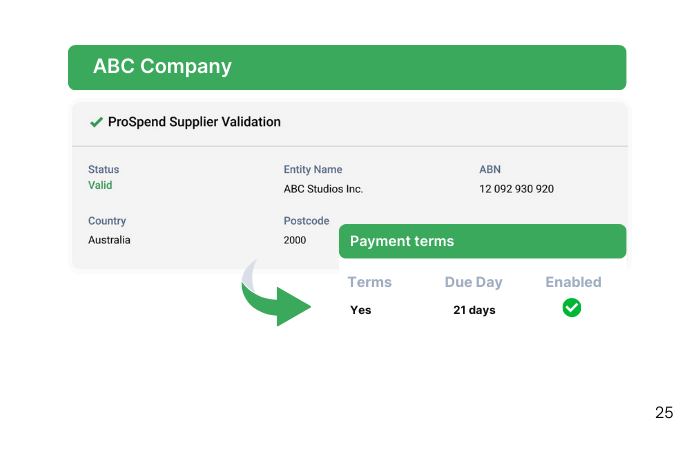

Manage supplier data in one reliable place

By leveraging an integrated supplier database, ProSpend helps businesses manage supplier relationships more effectively while driving efficiency and accuracy across the board.

-

Integrated database

-

Supplier maintenance

-

Trading term options

Keep your suppliers in sync

Minimise errors and inconsistencies by maintaining a single source of truth for supplier details.

The database can be maintained easily through a one-off update, import or synchronisation with a range of ERPs.

.png)

Highly configurable options for suppliers

Get full control by AP for supplier maintenance, including:

- Invoice delivery method

- Auto coding - cost centre and g/l code

- Data extraction options

- Payment terms

- Approval workflow

- Currency

- PO Matching

Pay suppliers on your terms

Configure how you want to pay. On scanning the invoice into ProSpend our software will use your preferred configured supplier due date.

What our customers say

The smartest and most efficient way to manage your spend.

"I believe it is an excellent choice for any organisation seeking a streamlined and efficient AP process."

“The expensemanager (now ProSpend) invoice module has automated our accounts payable process. As a result we have saved hard dollars in printing, filing, storage and man-hours. ”

"We’ve reduced the time to process a supplier invoice approval and payment by a number of days, it’s visible to everyone and now paper-free."

.png?width=52&height=52&name=Baskin%20Robbins%20Logo%20(3).png)

What our customers say

The smartest and most efficient way to manage your spend.

"We’ve reduced the time to process a supplier invoice approval and payment by a number of days, it’s visible to everyone and now paper-free." - Jamie Hughes

“The expensemanager (now ProSpend) invoice module has automated our accounts payable process. As a result we have saved hard dollars in printing, filing, storage and man-hours. ” - Gavin Finn

.png?width=200&height=125&name=Montessori%20Stacked%20(1).png)

"I believe it is an excellent choice for any organisation seeking a streamlined and efficient AP process." Danny Nassif

Need clarification?

What does ProSpend invoice scanning do?

Can the system match purchase order to an invoice?

Does the system recognize duplicate invoices?

Can you attach multiple documents to an invoice?

Is ProSpend mobile or tablet friendly?

Do you offer support for users?

Is AP automation expensive?

AP automation doesn’t have to be expensive. The key is to find an AP automation solution that fits your business’s unique needs and goals.

With ProSpend’s customisable modules, you can pick the features that you need. Calculate the estimated cost based on your chosen preferences with our Pricing Calculator.

Is AP automation worth it?

Definitely! With AP automation, you can reduce the amount of time handling tedious manual processes, improve accuracy, reduce invoice fraud and ensure compliance. This means better productivity, allowing you to focus more resources on your business goals.

How to implement AP automation?

We understand that every company is different. Based on your company’s workflow and structure, we at ProSpend develop a customised implementation plan with dedicated training and UAT sessions to help you transition and use our AP automation platform to the fullest.

Features

What does the ProSpend Expense Manager do for you?

Built to fit your existing finance processes, ProSpend streamlines employee expenses securely, efficiently, and at scale.

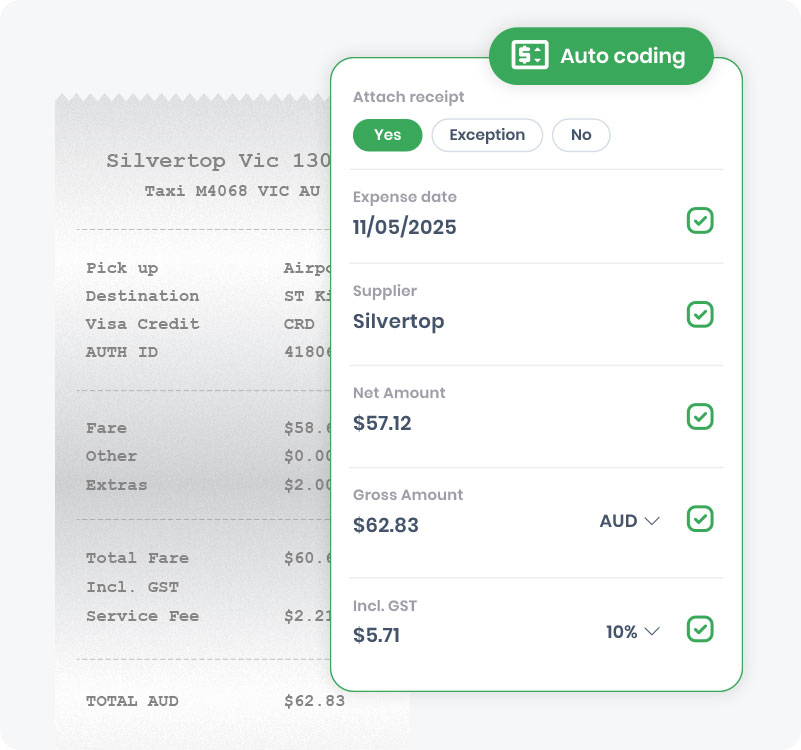

Keep every expense audit-ready by default

Stop the back and forth for missing receipts and unclear spend. Employees can snap a receipt, add the details and submit in a few clicks, while ProSpend keeps the evidence attached from day one for audit ready records.

- Mobile receipt capture (iOS/Android) plus web upload

- OCR receipt capture to reduce manual entry and rework

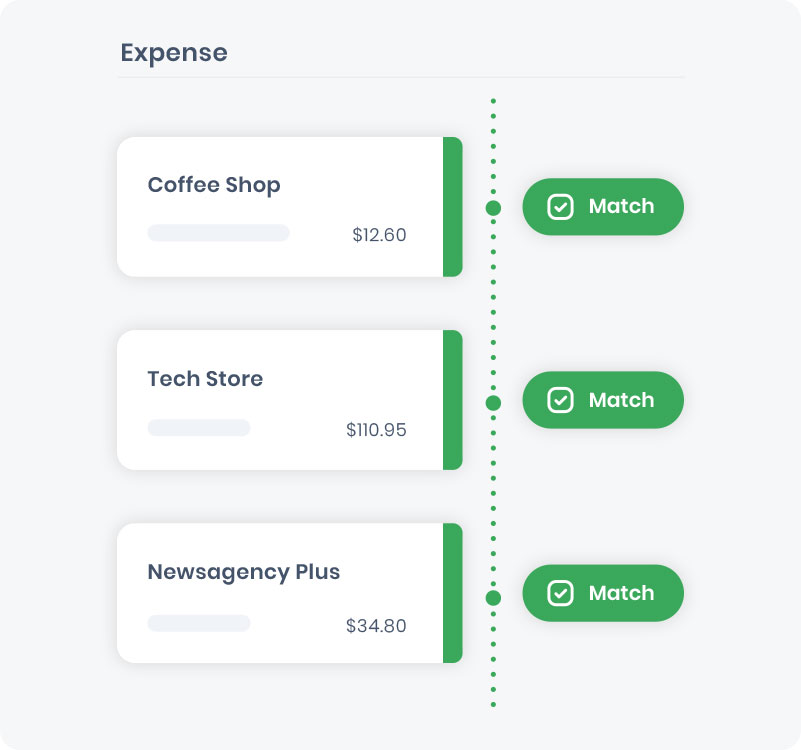

Stop chasing card receipts at month-end

Bring corporate card spend and receipts into one workflow. ProSpend imports daily card feeds where enabled, matches receipts to transactions, and flags missing receipts or exceptions early so month end close is smoother.

- Daily transaction feeds (provider dependent)

- Smart matching of receipts plus exception queues

- Missing receipts and out-of-policy flags

Expense claims that build themselves

Reduce admin for employees and reduce clean up for finance. With card data arriving daily, claims can be created automatically with consistent coding, so reporting is cleaner and finance focuses on exceptions instead of building expense lines.

- Auto-assembled claims from receipts and card transactions

- Standardised fields for reporting

- Finance focuses on exceptions, not compiling reports

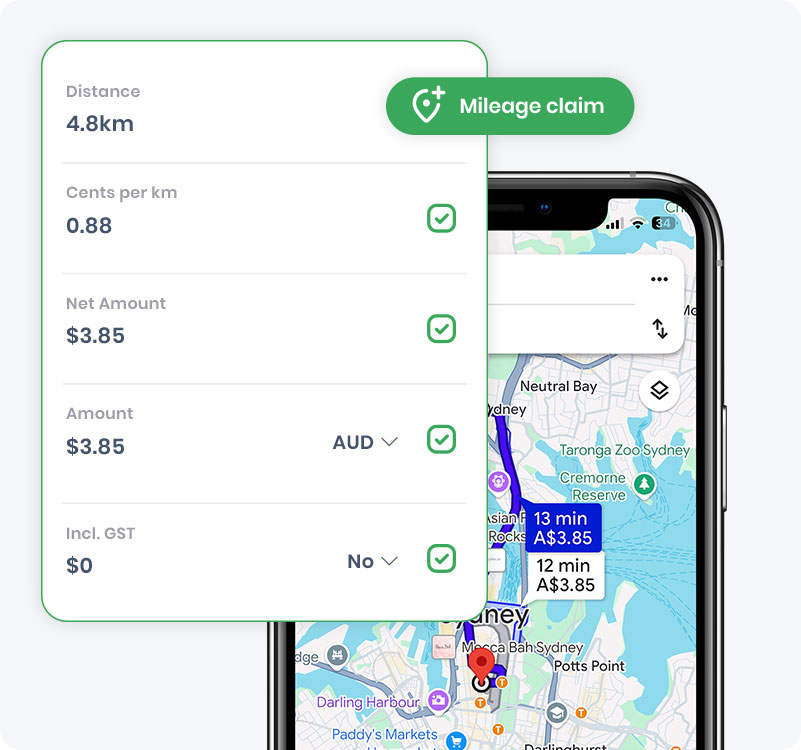

Track mileage and allocate costs without spreadsheets

Make mileage and allocations consistent without manual spreadsheets. Google Maps mileage is captured and reimbursements are calculated using your company rate, while split coding allocates one expense across projects, cost centres, or entities. The map image is saved as supporting evidence.

- Mileage support with mapping and automatic reimbursement calculation

- Split coding across projects, cost centres, and entities

- Save favourite splits for repeat expenses

Keep approvals moving without bottlenecks

Keep expenses moving through approvals without chasing managers. Route approvals by amount, department, project, or entity, and let managers approve or query via mobile or email. Every step is recorded with a clear audit trail of actions and comments.

- Multi-level approvals by amount, entity, department, and project

- Approve or query via mobile or email

- Timestamped audit history and comments

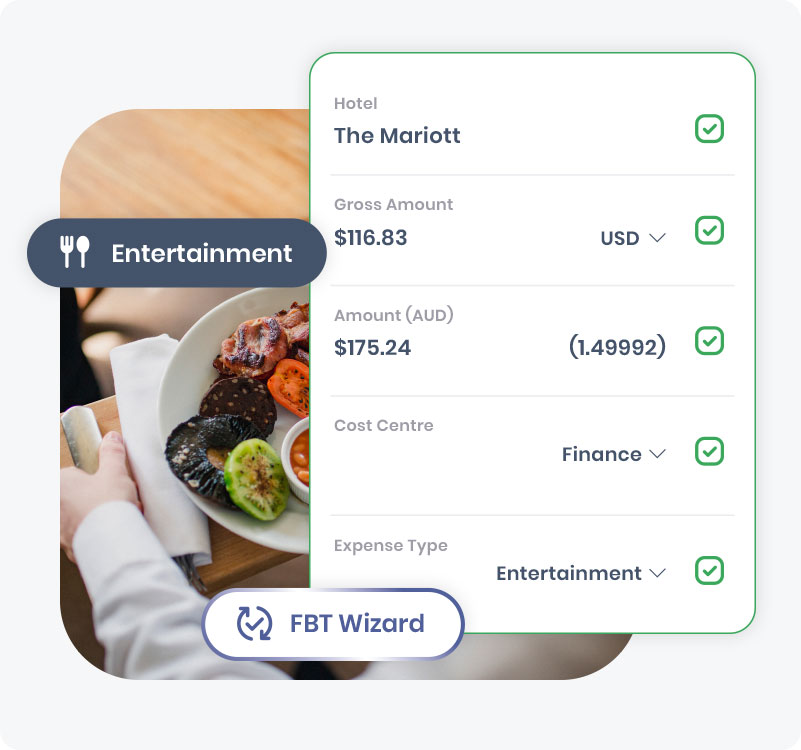

Stay compliant with GST and FBT

Reduce end of month tax clean up by capturing the GST and FBT details finance needs when expenses are submitted, including entertainment context.

Use configurable tax and FBT wizards for AU and NZ, track FBT using the 50/50 or actual method, and set GST edit controls by expense type for consistent treatment.

- Entertainment context prompts to reduce FBT follow ups

- 50/50 or actual FBT methods, plus reporting support

- GST edit controls by expense type for consistent handling

Over 1,000 customers trust us since 2015

Integrations with 30+ leading ANZ ERPs

Dedicated implementation and local support

MYOB Innovative App of the Year Finalist

FAQs

Expense Management Software

What is an expense management system?

An expense management system helps employees capture receipts, submit claims, route approvals and export approved expenses to finance with a complete audit trail.

How does the ProSpend Expense Manager work day-to-day?

Employees capture receipts (mobile/web), approvals follow your rules, and approved expenses export to your ERP with coding, tax treatment and attachments.

Compliance and controls (ANZ)

How does ProSpend support GST compliant expense claims?

It standardises key fields and retains receipts and approvals at line level to support consistent handling and audit readiness.

How does ProSpend help with FBT-related entertainment expenses?

It can prompt for contextual details finance teams typically need (such as purpose/attendees) and keeps them with receipts and approvals to reduce follow-ups. (High-level only.)

Workflow and features

Does ProSpend support corporate card reconciliation?

Yes. Where enabled, transactions can be imported regularly, matched to receipts, coded consistently, and exceptions (missing receipts/out-of-policy) flagged early.

Can we set multi-level approvals and policy rules?

Yes. Approvals can route by amount, entity, department, project and thresholds aligned to your policy.

Integrations and rollout

Does ProSpend integrate with Xero, MYOB, NetSuite or Dynamics 365 Business Central?

Yes. Approved expenses sync to your finance system with GL coding, tax treatment and attachments, reducing re-keying and errors. See all our integrations here.

How long does implementation take?

It depends on entities, workflows and integrations, but implementations are typically delivered in weeks with local onboarding and support.

Ready to see it in action?

Take control of employee expenses without adding headcount.

- Built for ANZ mid-market finance teams

- Integrates with your ERP (Xero, MYOB, NetSuite, Business Central and more)

- Supported by local experts